The Comptroller’s Office has established a dedicated email address - to assist businesses with extension-related questions. In hopes of providing additional relief, Comptroller Franchot today sent a letter to IRS Commissioner Charles Rettig requesting the same forbearance period for federal monthly business tax payments.Īlso, if the IRS extends its Apfiling deadline for 2020 corporate, pass-through entity and individual income tax returns, Maryland will once again conform to the IRS action. Employers must still file and pay Federal withholding taxes. Any State withholding returns and payments originally due between Februand Apmay be submitted by Apwithout incurring interest and penalties. “Just like last year when we gave businesses a breather, after 90 days, taxpayers will remit what is due, ensuring this action is budget neutral for the State of Maryland.”Įmployers must complete their 2020 withholding tax returns and payments due by January 31, 2021, ensuring that W-2s will be delivered on time for taxpayers to file when the tax season begins at the end of January. “As businesses await approval of applications for grants and loans, receipt of funds and additional federal government action, these tax extensions immediately alleviate financial pressures during challenging times,” Comptroller Franchot said.

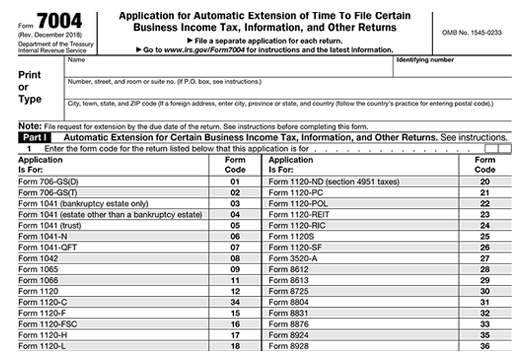

“My directive for a tax forbearance that is interest and penalty-free is a direct and immediate economic stimulus for Maryland businesses and workers - a decision that we estimate keeps more than $1 billion in consumers’ pockets and helps businesses keep their lights on,” said Comptroller Franchot.Īccording to the Office of the Comptroller: No interest or penalties will be assessed and there is no need to file a request for an extension. The actions are similar to an extension granted last year to businesses during the early stages of the COVID-19 pandemic. The extension applies to business taxes administered by the Comptroller: sales and use, admissions and amusement, alcohol, tobacco, and motor fuel tax, as well as tire recycling fee and bay restoration fee returns and payments with due dates between Januand April 14, 2021. Do you want an extension of more than 5 months? Then you must explain why you need such a long extension in your application.Comptroller Peter Franchot today announced that his agency has extended filing and payment deadlines for certain Maryland business taxes and quarterly estimated income tax returns and payments that would be due in January, February, and March 2021 until April 15, 2021.Īlong with eligible businesses, self-employed individuals or independent contractors with estimated income tax returns and payments due on January 15, 2021, will be granted an automatic extension until April 15, 2021. The Tax and Customs Administration will send you a written response within 3 weeks of your application.

You apply for an extension until 1 November. You can do so in various ways (in Dutch).

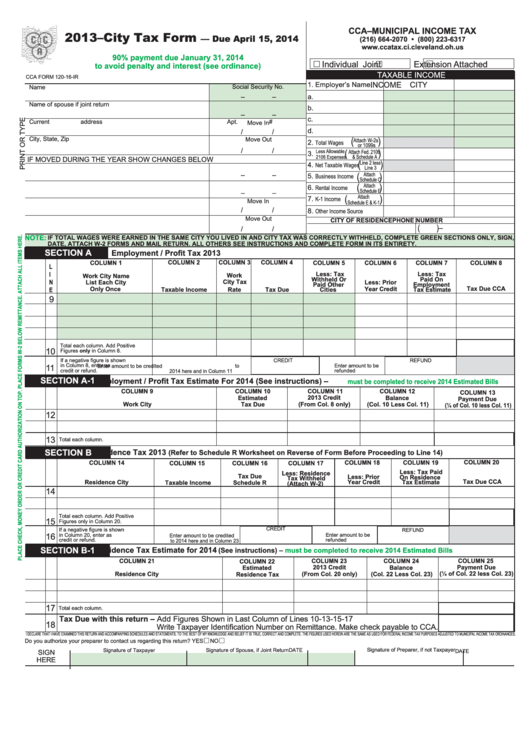

You can apply for an extension for filing your corporate income tax return between 1 April and 1 June. Do you want an extension of more than 5 months? Then you must explain why you need such a long extension in your application. You can do so until the date that is stated on the declaration letter sent by the Dutch Tax and Customs Administration. You can apply for an extension for filing your income tax return in various ways (in Dutch). You must do so before the final return filing date, otherwise you will still risk a fine. If you have to file an income tax return or a corporate tax return in the Netherlands, but are unable to do so before the due date, you can apply for a tax filing extension.

0 kommentar(er)

0 kommentar(er)